'Does ESG help companies?' session report for 'From Vision to Action' at TUJ

- Donald Eubank

- Dec 2, 2019

- 6 min read

Updated: Aug 2, 2020

!["Ninety percent of bankruptcies in the S&P 500 between 2005 and 2015 were of companies with poor [E&S] scores five years prior."](https://static.wixstatic.com/media/27a16a_6f7745110f47475882d4407828f6ec93~mv2.png/v1/fill/w_640,h_548,al_c,q_85,enc_avif,quality_auto/27a16a_6f7745110f47475882d4407828f6ec93~mv2.png)

‘Does adopting ESG principles actually make companies better?’ Session Outputs

November 25, 2019

The major takeaway from our contributors to the third session of “Vision to Action: Sustainability in Business" on whether ESG principles actually make companies better was that each industry is different and companies need to focus on the criteria that are most important to their business and sector. And, while one industry might need to put more emphasis on Social criteria and another on Environmental ones, Governance is critical for all business.

It is important to highlight that with renewed focus on stakeholders over shareholders, businesses cannot ignore the Social criteria, which have up to now been the most difficult for companies to think and talk about. The key to progressing on ESG and sustainability integration is getting boards and executives to understand the concepts. They, in turn, should work in partnership with investors to collaborate on solutions.

At the end of the day, what investors want to know is that company management is aware of ESG issues arising from the current and future transformations in the physical world, energy mix, and business environment, so that they can equip their businesses to best survive in these changing times. Doing so not only reassures investors, but it also creates resilient organizations that excite employees and attract new talent.

Session presentation: Does ESG really make companies better?

Our full session synopsis:

The Academic Perspective: How ESG affects companies, and how to make them more resilient

Academic presentation: Sustainable Finance and ESG Principals in Japan

Questions under consideration

What sectors are at risk?

How does it actually affect companies and how can we make companies more resilient?

What does actually useful in terms of making companies more resilient?

Meta-study: ESG and financial performance: aggregated evidence from more than 2000 empirical studies

by Gunnar Friede, Timo Busch & Alexander Bassen

Major findings:

There's a clear correlation between ESG integration at the firm level and corporate financial performance

Companies perform particularly well when they focus on the ESG issues that are most material to their specific field, for example:

o If mining companies focus on environmental issues, they perform very well

o Service companies perform particularly well when they focus on social issues, if they focus more on environmental, the effect is not as strong

Physical transition risks in Japan

4.1 million people at risk from flooding of coastal plains

Higher frequency of typhoons

o Destruction of upwards of 120 bullet train cars from rivers flooding during recent typhoons

Temperature rise in Japan above the global average

o Higher heat results in increased use of air-conditioning, creating a viscous cycle

Sakura season happens earlier and the period is shorter (some trees bloom twice in the year)

o Potential impact on tourist industry

The Investor Perspective: How asset managers can approach ESG

A representative of a major asset manager described their approach to developing ESG criteria and engaging with companies on ESG issues, including of a discussions of the following questions:

1. How are ESG criteria used to assess companies?

a. For assessment of your total portfolio, choose a wide range of criteria – upwards of 30 to 40 – from ESG analysts who take into account the specific nature of different industries

b. For a specific industry, focus on 15 to 20 criteria each time and rate a company against competitors within the sector globally, based on best practice

2. How can ESG criteria be used to engage companies?

a. Combine assessment into a single report that highlights the importance of each rating

b. Identify the weaknesses and raise a conversation with companies on where they should improve

3. The situation in Japan

a. Many companies are not disclosing ESG issues as the think that investors are not interested in them

b. Asset managers need to educate Japanese companies about the interest of investors in seeing ESG disclosures and convince them to provide them

c. Japanese firms like to “follow the leaders” in terms of disclosure of energy commitments

4. The use of exclusions

a. Create clear standards on what kinds of companies not to invest in

b. Consider excluding companies from your portfolio that are heavy emitters of carbon or directly involved in the extraction of fossil fuels, especially coal

5. Does ESG need to become compulsory in Japan?

a. In the past five years, ESG disclosure is progressing without regulatory frameworks

i. Many contacts are made with ESG researchers to understand their weaknesses

b. Blanket coverage of all companies would be difficult

i. Large companies have the organizational structure to support reporting

ii. But for mid/small-size companies, no need to apply same requirements

The Corporate Perspective: How can companies harness ESG

1. How can companies communicate with investors?

a. Identify the risks in your industry and the opportunities

b. Understand the ESG criteria that investors are focused on

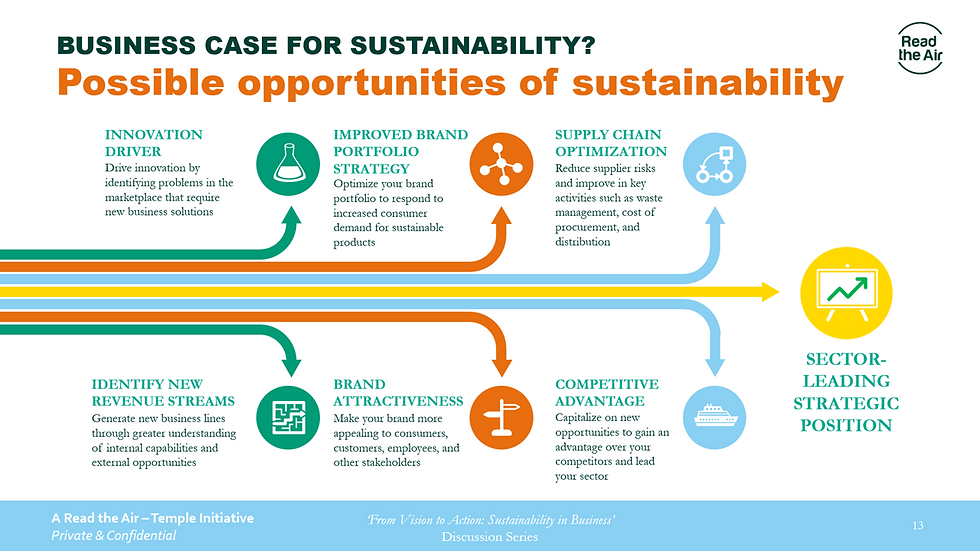

2. What are the opportunities?

a. Improving your corporate image

b. Discovering new future markets

c. Creating innovative products

d. Become more attractive to prospective long-term investors

i. Increase ESG-based investment

ii. Stabilize stock price

3. How should you prepare for investors’ questions

a. Preparation for inclusion on sustainability/ESG indices

i. This organizes the information required for different criteria

ii. And reveals which criteria you are not able to disclose anything on yet

b. Discuss with different departments the kind of information that they can provide for different ESG criteria

i. For example, HR or marketing

c. Disclose ESG information in annual and CSR reports

4. Concrete actions that a company can take based on ESG/impact on culture

a. Drive innovation for underserved communities

b. Increase employee motivation and engagement with such projects

Breakout on ESG engagement between investors and companies

Discussion groups were presented with one of two case studies*: Cosemo, a cosmetics company facing the typical industry issues around manufacturing, i.e. transparency and trace-ability, green formulations, sustainable packaging, climate change, water management, and social impacts; and OnPeeps, a staffing business concerned with services company issues such as human rights, labor rights and diversity, compensation and benefits, employee health and safety, staff-management relations, climate change, geopolitical, economic and physical uncertainty.

The discussion groups were then subdivided into investors and company team members, and then held separate conversations, the investors exploring what they wanted to engage the companies with; and the company members discussing their current activities and how they would present them to the investors. Finally the two parties engaged in a discussion of the company's ESG stance and how the investors would like to see the business improve their efforts.

* All case study material is owned by Read the Air, a Vizane KK initiative.

CASE STUDY: Cosemo

Cosemo has committed to improve its ESG position on emissions, packaging, ingredients and employee safety.

— Investor focus on Cosemo's ESG status

Were worried about labor practices due to the caustic nature of the some of the processes

Wanted to understand material sourcing and the supply chain better

Both were considered to present potential reputational risks

Concerned that Cosemo did not prioritize human rights, and therefore

Wanted to understand how they were testing their products

— Company response

Were confident that they could demonstrate a commitment to reducing emissions, improving packaging and ensuring employee safety

Understand that they were not very clear on their ingredient sourcing and needed to work on this field

Admit that the shift to non-fossil fuel based products is difficult in the cosmetics industry, because alternatives such as palm oil have their own problems

CASE STUDY: OnPeeps

OnPeep has committed to improve its access to work and workers, gender equality, safety of work environments and community outreach.

— Investor focus on OnPeeps' ESG status

Stated priorities didn't match the items in the top right quadrant (important to stakeholders and important to OnPeeps)

Thought that data security should be at the top of the agenda

Labor practices and business ethics were not positioned as enough of a priority

Access to work/workers and gender equality were well quantified, though percentage was wrong metric for gender targets

Safe work environments and community outreach did not seem relevant to the staffing industry

Wanted to know more about what kind of contracts they were providing, especially concerning gender equality, flexibility and part-time/full-time opportunities, and

What were the compensation guidelines

Felt that the company was generally able to respond appropriately to their concerns

— Company response

Understood the concern with data security and committed to providing more clarity about the issue

Had discussed previously to the engagement that they need to better highlight the importance of labor/business practices and gender equality, and so were prepared to respond to investor concerns

— Next steps

How to improve your ESG approach, from Sustainability: What It Is and How to Measure by Gilbert S. Hedstrom

Based on four buckets to the right:

List all your current sustainability and ESG initiatives

Map each to one of these four ‘buckets’

Quantify the benefits of each initiative

If an activity doesn’t fall into one of the buckets, think about whether you should be doing it

You can explore more on what you can do in your business:

Find more materials on ESG and how businesses are embracing sustainability at the 'Vision to Action' Resource Center

Read the Air—Trista Bridges and Donald Eubank are cofounders and principals of Read the Air, a Tokyo-based specialist advisory service that enables companies to put sustainability at the core of their business, for purpose and profit. Read the Air guides commercial enterprises in designing, implementing and executing powerful business strategies that create sustainable business models.

Follow Read the Air on LinkedIn

Subscribe to our mailing list for updates on posts

Follow us on Twitter at @_read_the_air_

Contact us directly at info@readtheair.jp

Yorumlar